To check whether an Income Tax Number has already been issued to you click on Semak No. This unique number which is the TIN is known as Nombor Cukai Pendapatan or Income Tax Number.

Business Income Tax Malaysia Deadlines For 2021

This section provides an overview of domestic rules in the jurisdictions listed below governing the issuance structure use and validity of Tax Identification Numbers TIN or their functional equivalents.

. 777 South Figueroa Street. For Malaysian citizens and permanent residents you can find your Income Tax Number on your tax returns. Sila masukkan e-mel seperti format berikut.

In Malaysia a 12-digit number format. Click on ezHASiL. Citizen or resident child but who cannot get an SSN for that child in time to file their tax return.

The jurisdiction-specific information the TINs is split into a section for individuals and a section for. This number is issued to persons who are required to report their income for assessment to the Director General of Inland Revenue. StashAway Malaysia Sdn Bhd 201701046385 is licensed by the Securities Commission Malaysia Licence eCMSLA03522018.

An Adoption Taxpayer Identification Number ATIN is a temporary nine-digit number issued by the IRS to individuals who are in the process of legally adopting a US. You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready. Tax Identification Number TIN According to the notice from the Inland Revenue Board of Malaysia the Tax Identification Number TIN has been officially implemented starting from 1st January 2022.

Taxable income MYR Tax on column 1 MYR Tax on excess Over. If you were previously employed you may already have a tax number. The Tax Id Number Division of most states counties or cities is responsible for licensing most type of business established within the State County or City Limits and for the businesses coming into the State County or City to perform a service ie contractors engineers consultants and many more.

However there are individuals and entities who are. MISSION INFO. Example for Individual File Number.

03-8911 1000 Local number 03-8911 1100 Overseas number. SG 10234567090 or OG 25845632021 For individual ITN the end number can be either 0 or 1 which indicates the husband or wife. Income Tax Return Form ITRF ezHASil e-Filing is a most convenient way to submit Income Tax Return Form ITRF.

Tax Id Number Division Information. Sila masukkan e-mel dan nombor telefon yang berdaftar dengan LHDNM untuk memaparkan nombor cukai pendapatan dan cawangan anda jika ada. This is the responsible agency operated by the Ministry of.

Registering for a Malaysian tax number is not very complicated. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. Mwlosangelesatklndotgovdotmy Official Correspondence laxdotinfoatklndotgovdotmy Consular Matters Twitter CGLAMsia Facebook.

PUTRAJAYA Jan 9 The government will introduce a Tax Identification Number TIN for business or individual income earners aged 18 and above beginning in January 2021 said Deputy Finance Minister Datuk Amiruddin Hamzah today. Prior to January 1 2004 a separate social security SOCSO number also the old IC number in format S S denotes state of birth or country of origin alphabet or. Personal income tax rates.

Click on e-Daftar. Form W-7A Application for Taxpayer Identification Number for Pending US. Malaysian Income Tax Number ITN or functional equivalent In Malaysia both individuals and entities who are registered taxpayers with the Inland Revenue Board of Malaysia IRBM are assigned with a Tax Identification Number TIN known as Nombor Cukai Pendapatan or Income Tax Number ITN.

Malaysia Information on Tax Identification Numbers Section I TIN Description Malaysian Income Tax Number ITN The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the Board. The Type of File Number and the Income Tax Number. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic.

YYMMDD-SS-G since 1991 known as the National Registration Identification Card Number NRIC No is issued to citizens and permanent residents on a MyKad. Type of File Number 2 alphabets characters SG or OG space Income Tax Number maximum 11 numeric characters Example. This initiative would ensure no taxpayers fail to fulfil their tax obligations while providing justice to those.

Register Online Through e-Daftar. This unique number is known as Nombor Cukai Pendapatan or Income Tax Number. Visit the official Inland Revenue Board of Malaysia website.

Go through the instructions carefully. Suite 1101 Los Angeles CA-90010 Call Us. KUALA LUMPUR Oct 22 While details of the Tax Identification Number TIN initiative announced in the 2020 Budget are still forthcoming tax experts believe it will increase the number of registered taxpayers reduce tax arbitrage activities and prevent any losses in government revenue.

Click on the e-Daftar icon or link. An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia. Suite 600 Los Angeles California.

You just need to enter your income deduction. Semakan Nombor Cukai Pendapatan Individu Lembaga Hasil Dalam Negeri Malaysia. The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the Board.

Adoptions is used to apply for. Click on the borang pendaftaran online link. How do I find my taxpayer identification number.

Whether buying a car or properties in the name of an individual or a company must have a TIN. You can do the registration either on-line or at the nearest branch of the Malaysian Inland Revenue Board IRBM Lembaga Hasil Dalam Negeri Malaysia. Finance Minister Lim Guan Eng during the tabling of.

Taxpayers who already have an income tax number do. 1-213-892 1238 General enquiries 1-626-766 0478 For emergencies Fax.

Business Registration Number In Malaysia Acclime Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Business Income Tax Malaysia Deadlines For 2021

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Malaysia Personal Income Tax Guide 2021 Ya 2020

Guide To Using Lhdn E Filing To File Your Income Tax

Malaysia Sst Sales And Service Tax A Complete Guide

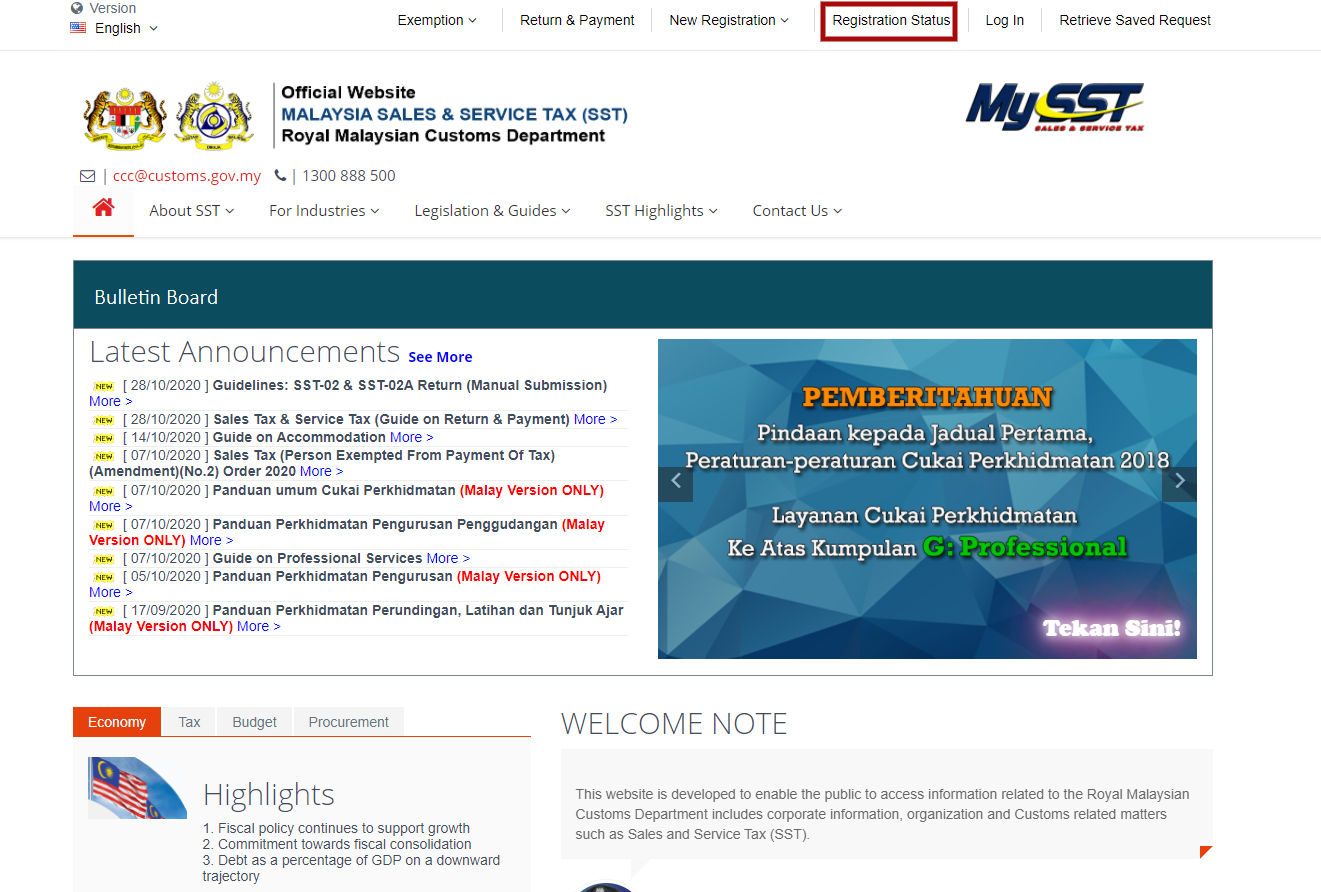

How To Check Sst Registration Status For A Business In Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide

Individual Income Tax In Malaysia For Expatriates

How To Check Sst Registration Status For A Business In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

.png)

How To Check Your Income Tax Number

Pengumuman Penting Imigresen Malaysia Berlaku Selama Mco